Everyone wants to get wealthy, but most people don't know one of the simplest ways to do so. Compound interest allows you to invest small amounts of money and turn it into a huge amount over time.

In order to build wealth, it is absolutely necessary to invest for the long term. Investing early is powerful and allows you to make more money in the long run.

Rome wasn't built in a day, but it was worked on every day.

Great things take time and it is necessary to keep investing toward your financial goals consistently. If you continue to build over time then you will be rewarded with a great fortune.

The concept of compound interest will allow you to generate wealth, but it is important to start investing early. It takes money to make money, but it also takes time.

What is Compound Interest?

A lot of financial terms are very confusing which forces people to shy away from financial education, and yes compound interest is one of them.

The official definition of compound interest has too many fancy words, so I'm going to simplify it for you.

Compound interest is when you earn interest on both the money you’ve saved and the interest you earn.

So, basically, you start with an initial investment that earns a certain return of money. The next year, that money gets reinvested and now you earn even more money on your initial investment, along with the money you earned from investing.

Compound interest is interest earned on interest.

This mathematical equation allows your small investment to slowly snowball into a bigger sum of money. Consistency will turn your hundreds into thousands and then thousands into millions.

Example

Let's say you have an initial investment of $1000 and it earns 8% annually, and you do not contribute any other funds to it. Let's take a look at what it would look like after 5 years.

After year one, the account would have $1,080 dollars in it due to the 8% return. Going into year two, your account would earn a return on the full $1,080 as opposed to just the $1000 thanks to compound interest.

Year two your balance would be $1,167 as a result of earning 8% on the $1,080. The same rule applies to the rest of the time.

Year 1: $1,080

Year 2: $1,167

Year 3: $1,260

Year 4: $1,361

Year 5: $1,470

So, over 5 years your money returned $470 thanks to compound interest.

Now, obviously this is not a huge amount of money, this was just a simple example for everyone to understand.

In order for you to fully maximize the benefits of compound interest, then you have to contribute to your investment account every year.

Example

Let's say you took that same $1000 investment and it earns 8% annually, but now you contribute $1000 every year to it.

After 5 years, your balance would be $7,806.

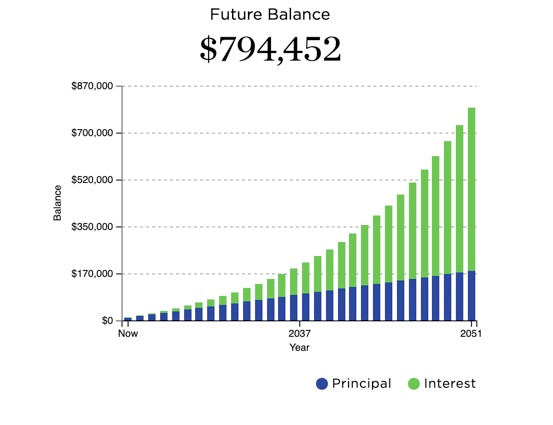

After 30 years, your balance would be $132,409.

That's the power of compounding. Your small contributions will eventually grow overtime. Unlike simple interest where you only receive interest on your initial investment, compounding allows you to get returns on your returns, so you earn a lot more money.

Where to Invest

If you've made it this far into the article, then you are probably thinking about beginning your investing journey.

You may be wondering where the best place to start investing is. I believe that a Roth IRA is one of the best places to put your money into.

A Roth IRA is an individual retirement account that has tax-free earnings growth and tax-free distributions.

Due to these tax-free incentives, a Roth IRA is a great way to invest your money and build wealth. Once retirement rolls around, you can be financially independent.

A Roth IRA allows you to contribute up to $6,000 a year towards your retirement which will drastically amplify your compounding abilities.

Retirement Planning on AutoPilot

When it comes to investing, time in the market is way more important than timing the market. The stock market will have its ups and downs, but if you are investing for the long term then you shouldn't be worried.

There are several automatic investing plans which allow you to contribute monthly towards certain types of accounts. This will automatically put money in your account from your earnings so you don't have to worry about doing it manually.

This is a great way to make sure that you are consistently investing towards your future.

As mentioned previously, you want to reinvest your gains and any dividends that you are paid out to ensure that your compounding is fully maximized.

Just Start

Everyone wants to get rich, but you will never see any returns on your money if you never make an investment.

Just start and let compound interest change your life.