If you are looking to generate passive income and build wealth, but don't know where to begin, then dividend investing is a great place for you to start.

The dividend investing strategy provides investors with two sources of potential profit. The first is from the belief that the stock will grow and appreciate over time, and the second is the dividend payout that the investor receives from the company from holding their stock.

What is a Dividend?

In order to build a stable cash-flowing portfolio, many investors suggest purchasing stocks that pays a dividend. That way when you receive the payouts, you can use that money to purchase even more dividend paying stocks.

Dividends are authorized payments that are paid out to the shareholders from the company’s earnings.

Essentially, if you hold a company's stock, they will pay you a certain percentage either quarterly, or annually.

Why do Companies Pay Dividends?

If you are new to investing, you are probably wondering why certain companies pay dividends.

Simply put, most of these companies have too much money and if they were to invest it in themselves, they simply wouldn’t make enough of a return on the available cash.

Due to this, the companies decide to share their profits with their shareholders. Since they are paying out dividends to their shareholders, they are obviously going to be a more attractive investment for investors, which is going to make people want to stick around.

Not every company pays out dividends. Obviously in order to have the cash to pay dividends, you need to be turning a profit.

This is why dividends are more common with well-established companies who have been around for a long time. This is attractive to investors because they know that they will be getting a payout regardless of how the stock is performing.

How Dividends Work

Let's say you purchase 100 shares of a company that pays out a dividend of $0.50. This means that you would receive a $50 dividend payment. Now what you do next with that payout is up to you.

A popular strategy that long term investors use is called (DRIP) or dividend reinvestment plan.

Essentially, they take the cash they would receive from the dividend payout and choose to reinvest it into the same stock, or into another dividend paying company.

The decision is ultimately yours, but if you are looking to build wealth, then reinvesting the cash is probably your best option.

Examples of Dividend Stocks

Here we take a look at some well known companies' dividend information.

| Company | Dividend Yield | Quarterly Payout |

|---|---|---|

| Apple ($AAPL) | 0.53% | $0.22 |

| Pepsi ($PEP) | 2.63% | $1.075 |

| Target ($TGT) | 1.44% | $0.9 |

Dividend Terminology and Metrics

As I mentioned earlier, investing terminology can be intimidating for first time investors. It is important to do your research and develop an understanding of these terms when investing in your future.

Let's take a look at important terminology and metrics you need to understand. (via Investopedia)

Dividends: Dividends are authorized payments that are paid out to the shareholders from the company’s earnings.

Dividend Yield: The ratio of the total annual dividends per share and the current share price. Evaluating the dividend payouts as a portion of the equity’s share price allows investors to compare the level of dividend income distributed in relation to the funds invested.

For example, if a company pays $4 per year and the stock’s price is currently $100, then your dividend yield is 4%.

Dividend Payout Ratio: The ratio of the total amount of dividends paid out to shareholders relative to the net income of the company. It is the percentage of earnings paid to shareholders via dividends.

P/E Ratio: The ratio for valuing a company that measures its current share price relative to its earnings per share (EPS). The price-to-earnings ratio is also sometimes known as the price multiple or the earnings multiple.

Ex-Dividend Date: The date on which the company’s stock, or any other security, begins trading “ex-dividend,” or when a new investor will need to wait until the next period to receive a payout.

Start Investing ASAP

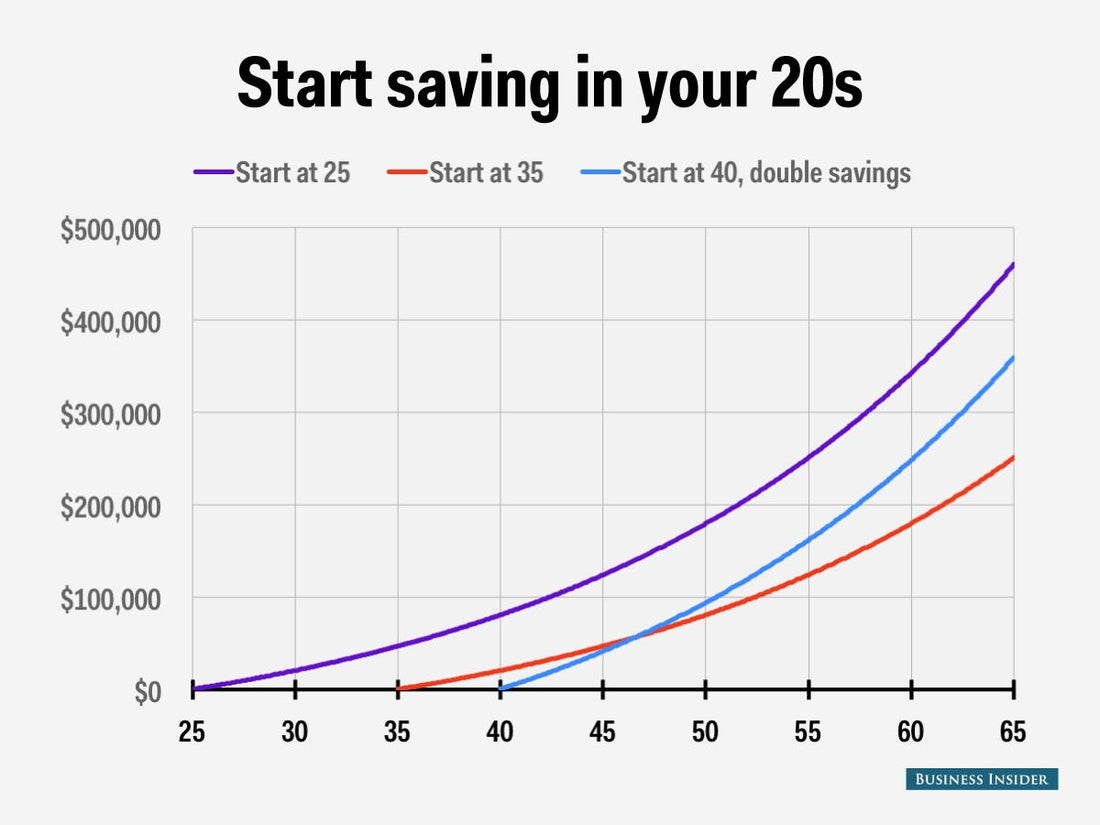

Every man needs to start investing as soon as possible. Investing is extremely important if you want to become financially free in the future.

Time is the most important thing to have on your side when it comes to investing. The earlier you start, the better.

Compound Interest is your best friend. Basically, your money makes more money. Then you take that made money and make even more money out of it. Then Repeat. Get it? Good.

If you don't start investing early, you will certainly regret it in the future. Every older person that is struggling financially always says the same thing- be smart with your money.

Give your money a job and let it work for you. Your future self will thank you. Get started with dividend investing.